Managing money wisely is essential for achieving financial security and maintaining a balanced life. Whether you’re an entrepreneur running a business or simply trying to stay on top of personal finances, developing smart money habits can help you reduce stress, make informed decisions, and achieve long-term financial goals. Without proper financial planning, it’s easy to fall into debt, struggle with budgeting, or miss out on savings opportunities.

Balancing business and personal finances requires a strategic approach that includes budgeting, saving, mindful spending, debt management, and investing. Establishing good money habits not only ensures a stable financial future but also allows you to enjoy life without constantly worrying about money.

One of the most effective ways to take control of your finances is by following a structured budgeting method. Budgeting helps allocate income efficiently, ensuring that both personal and business expenses are covered while still saving for future goals and financial security.

Smart Money Habits for Entrepreneurs – Budgeting, Debt Management, and Investing

Gain financial confidence with simple and smart money habits and actionable steps for budgeting, spending wisely, and achieving financial independence.

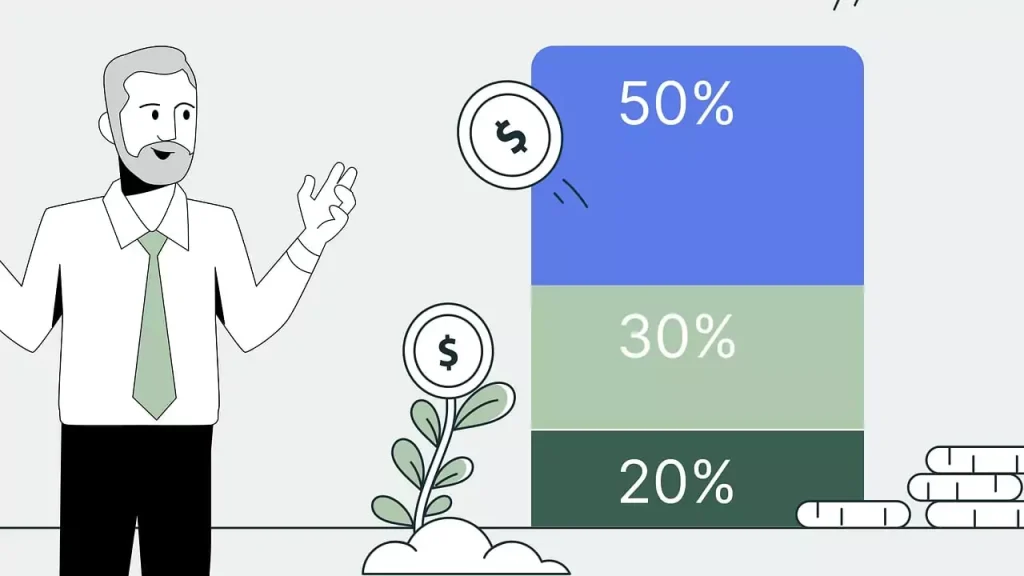

1. Understanding the 50/30/20 Budget Rule for Financial Stability

A solid financial foundation starts with budgeting. Many people struggle with allocating their income, often spending too much on non-essential items while neglecting savings. Have you ever wondered what is the 50/30/20 budget rule? It’s a popular and effective budgeting strategy that helps individuals allocate their income wisely by dividing it into needs, wants, and savings. This method ensures financial balance while allowing room for both essential expenses and future financial growth.

The 50/30/20 rule breaks down after-tax income into three main categories:

- 50% Needs: Essential expenses such as rent or mortgage payments, utilities, groceries, insurance, and business overhead costs.

- 30% Wants: Discretionary spending on entertainment, dining out, hobbies, travel, and non-essential business upgrades.

- 20% Savings and Debt Repayment: Allocated for emergency funds, retirement savings, investments, and paying off debts.

This approach helps individuals and business owners prioritize financial stability while still enjoying their hard-earned money. By following this rule, you can ensure that essential expenses are covered, indulge in life’s pleasures responsibly, and build wealth for the future.

2. Setting Clear Financial Goals for Business and Personal Life

Having clear financial goals is essential for long-term success and stability. Without defined objectives, managing money effectively becomes challenging. Whether you are planning to expand your business, save for retirement, or pay off debt, setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals can keep you on track.

For personal finances, common goals include:

- Building an emergency fund to cover unexpected expenses.

- Saving for a car, home, or major life event.

- Paying off student loans or credit card debt.

For business finances, goals may include:

- Scale the business without excessive borrowing.

- Setting aside funds for taxes and unexpected operational costs.

- Investing in marketing, technology, or employee training to improve efficiency.

Balancing personal and business financial goals ensures long-term stability and financial security in both aspects of life.

3. Smart Spending: Differentiating Between Needs and Wants

One of the key aspects of financial discipline is understanding the difference between essential expenses and discretionary spending. Many people struggle with overspending on non-essential items, which can lead to financial stress and debt.

For personal finances, a simple way to control spending is:

- Avoid impulse purchases by following a 24-hour rule before making a non-essential purchase.

- Cash or a debit card instead of credit is used to stay within budget.

- Tracking expenses with budgeting apps or spreadsheets.

For businesses, managing expenditures wisely can prevent unnecessary financial burdens. Ways to control business spending include:

- Investing in essential tools and resources that bring long-term value.

- Avoid unnecessary luxury office upgrades or excessive marketing expenses.

- Regularly reviewing business financial statements to identify areas for cost-cutting.

- Being mindful of spending habits helps maintain a healthy cash flow and ensures financial resources are used effectively.

4. Building an Emergency Fund for Stability

An emergency fund is essential for financial security, whether for personal or business use. Without a financial safety net, unexpected expenses can force individuals or businesses to rely on high-interest credit cards or loans.

A good rule of thumb is to save:

- 3-6 months’ worth of personal living expenses.

- 3-6 months’ worth of business operating costs.

To build an emergency fund:

- Allocate a fixed percentage of income each month.

- Cut back on unnecessary expenses to free up funds.

- Keep savings in a high-yield savings account for easy access while earning interest.

- Having a financial cushion helps prevent setbacks and allows individuals and businesses to navigate tough times with confidence.

5. Smart Debt Management: Paying Off Debt Strategically

Not all debt is bad, but managing it is important for financial freedom. Understanding the difference between good debt (investments in real estate, business, or education) and bad debt (high-interest credit card debt or payday loans) is key.

Effective debt repayment strategies include:

- Debt Snowball Method: Paying off the smallest debts first for psychological motivation.

- Debt Avalanche Method: Paying off debts with the highest interest rates first to save money.

- Refinancing or consolidating loans to reduce interest rates and simplify payments.

- For business owners, keeping debt levels manageable ensures financial flexibility and long-term success.

6. Investing for Long-Term Wealth and Smart Money Habits

Investing is an essential part of building wealth. Smart investments help individuals and businesses grow financially over time.

For individuals, common investment options include:

- Stocks, mutual funds, and ETFs for wealth growth.

- Real estate investments to generate passive income.

- Retirement accounts (401(k), IRAs) to secure a financial future.

For business owners, reinvesting in the company can lead to expansion and higher profitability. It may include:

- Upgrading technology for better efficiency.

- Investing in marketing and customer acquisition.

- Expanding business operations strategically.

- Diversifying investments reduces financial risk and ensures long-term financial stability.

7. Practicing Mindful Financial Habits for Long-Term Success

Developing mindful money habits is essential for sustained financial stability. Financial mindfulness involves:

- Creating a monthly financial plan and sticking to it.

- Automate savings and debt payments to stay on track.

- Review financial progress regularly and make necessary adjustments.

- Practicing delayed gratification, saving for larger goals rather than making impulsive purchases.

- Being intentional with finances leads to a balanced and stress-free financial life.

Smart money habits are the foundation of a balanced and successful life. By incorporating effective budgeting methods, setting clear financial goals, controlling spending, managing debt wisely, and investing in the future, individuals and business owners can create a secure financial future.

Closing Statements: Smart Money Habits

Applying strategies like the 50/30/20 budget rule, building an emergency fund, and making mindful financial decisions can make a significant difference in achieving stability. Whether managing personal expenses or business finances, developing these habits ensures long-term growth and financial peace of mind.

Financial stability is not about restriction but about making informed decisions that allow for both security and enjoyment. Start today, implement small changes, and gradually work toward a financially confident future.

Related Content: Top 15 Passive Income Ideas